Onbrane Asset-Backed

Features

Market trend

What's hot on the CP Asset-Backed markets?

Market challenges

Several challenges to be addressed in these markets.

Strong demand for efficiency

Today, the processes for communicating the underlying assets that secure debt issues are particularly long and painful. The regulation on securization remains very heavy and which brings lot of ineffiecy, even with regular counterparties.

Lack of knowledge

Too few investors really know about Asset-Backed financial instruments and how they work. They can also suffer from a bad reputation (too complicated to understand, risky...). They are therefore not interested in it.

Unsatisfactory liquidity

Despite the efforts to simplify the regulation of securization, many investors do not want to join this market or are disinterested in it because of the cumbersome processes and the difficulty of credit analysis. Improving these two points would help attract new investors and increase liquidity in the market (specially in Europe)

Lack of standardisation

The standardisation wanted by Securization Regulation (SECR) is not the success hoped for. ABCP markets need more standardization in order to simply regulation and credit analysis for investors and brings new actors in the market.

We are bringing simplicity and efficiency on asset-backed debt markets.

Our ambitions

Simplify the analysis and communication of Asset-Backed framweworks to make this market more efficient with more liquidity

Debt offering

Our platform is a cutting edge asset-backed debt platform

Debt lifecycle

We bring simplicity and efficiency in the asset-backed debt markets.

-

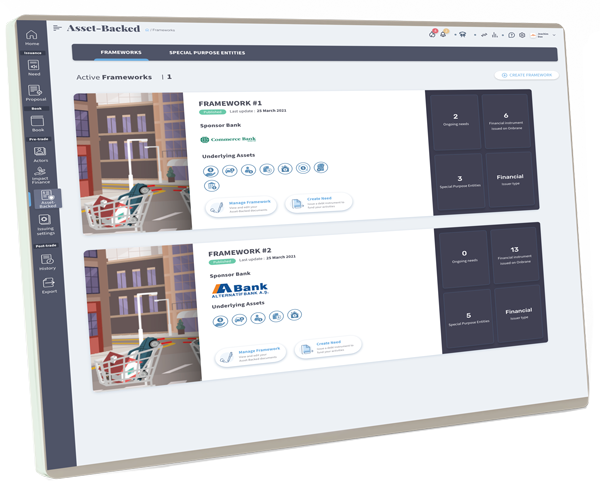

Framework builder

-

Collaboration workflow

-

Link to financing need

-

Marketing

-

Upload and create frameworks

-

Interact with intermediaries and investors

-

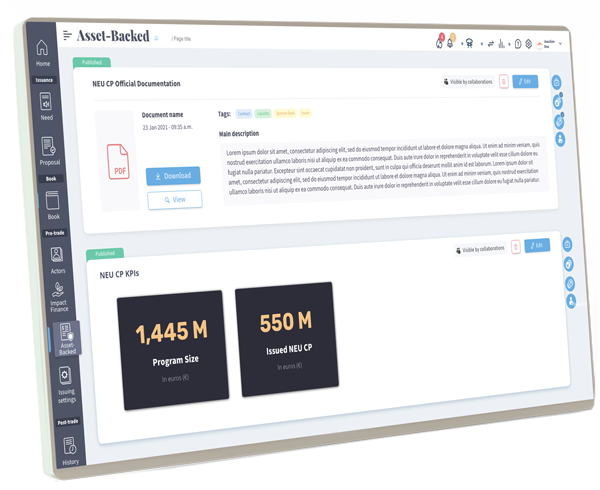

Share and validate regulation documents about securization

-

Communicate on your achievements

-

Update easily your documents

-

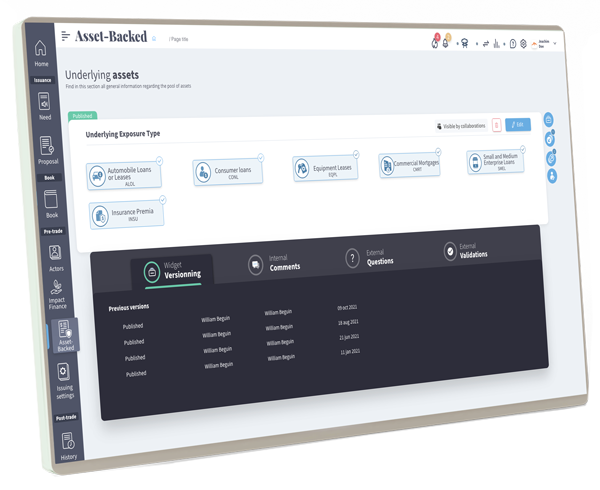

View all versions and receive questions

-

Build trust from third-party reviews

-

Validate and access to all reporting

-

Link debts with activities and indicators

-

Negotiate about assets refinancing

-

Track asset-backed debt allocations

-

Track asset-backed debt allocations

-

Introduce the Special Purpose Vehicle to new investors

-

Share key figures and help them to start their credit analysis

-

Questions and answers specific to each block and analysis by a trusted third party

-

Share your events and invite investors on Onbrane to participate

“We would also stress that the complexity of the regime has discouraged investors – and in particular small and mid-size investors – from entering the market, even where their sophistication would otherwise make securitisation investments appropriate..”

Survey about ABCP regulation, AFME, september 2021

Learn More

All our articles about asset backed finance